Cambensy, Casperson host college savings forum with Michigan Education Trust

MARQUETTE — Paying for college can be difficult, especially with the rising cost of education.

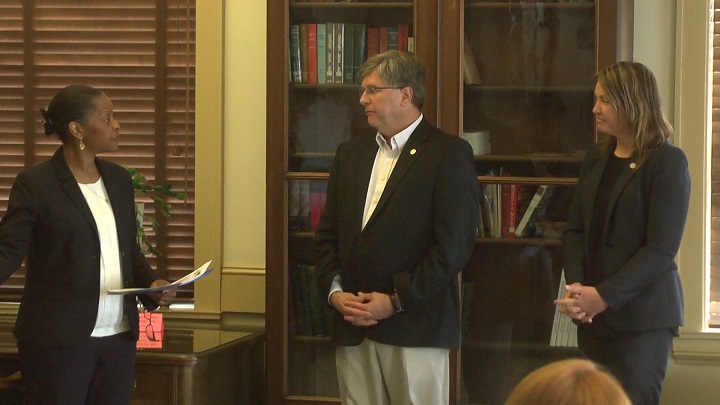

109th District Representative Sara Cambensy and State Senator Tom Casperson paired with the Michigan Education Trust to hold a college savings forum at the Peter White Public Library. Attendees could learn more about the tax-advantaged Section 529 college savings plans administered by the Michigan Department of Treasury.

“The vast majority of students right now are borrowing a lot of money because the financial aid packages they are applying for are largely comprised of loans. That’s money their going to have to pay back, with interested, so their education is going to cost even more,” said Robin Lott, the executive director of the Michigan Education Trust. “Anything [parents and grandparents] can do to help will reduce the amount of student loan debt that child is going to have coming out of college.”

A new MET survey found that while families in the U.P. value higher education, parents and grandparents are, on average, not saving for their child’s college or trade school education.

“I think if a lot of grandparents were aware of the program and realized how it worked would have an interested in investing in their grandkid’s future as well,” said state Senator Tom Casperson. “We just think it’s important to educate people that they have an opportunity. The programs are there, they just need to know about them.”

There are three different Section 529 college savings programs — the MET, the Michigan Education Savings Program (or MESP) and the MI 529 Advisor Plan (or MAP).

The MET plan allows families to purchase credit hours for future use at public state colleges, universities and trade schools. Families would purchase these credit hours at current prices and the company would then pay for those credit hours in the future.

According to Lott, the MESP plan works more like a 401K. Families pay into an account that their kids can use when they get into college.

To learn more about click the links below:

These plans offer Michigan taxpayers a state income tax deduction on contributions and potential tax-free growth on earnings if account proceeds are used to pay for qualified higher education expenses.